I don’t have anything remotely close to 6 months savings in the bank. It doesn’t make economic sense for me to do so. I’m far better off talking any would-be savings and put it towards all this debt I’m still carrying from my college days.

You will never make more interest on an investment than you will get charged interest for the same amount as a loan. Ever. It does not happen. So for me to sit on money that could go towards paying down debts, I’m just needlessly paying more in interest than I would be otherwise.

My current plan is to pay down or pay off all by debts (ultimately paying them off but if they’re close then ok); then consolidate all of my remaining debt into a line of credit, and close out all of my other debt accounts. When that’s paid, it will hopefully be enough that I can put that available credit towards any spontaneous costs, and if no such costs occur, save as much as I can so I won’t need the line of credit if I have incidentals. Hopefully saving up to 6 months or more, plus investing into a retirement fund.

The retirement fund is an afterthought because at this point in my life I expect that I will be financially incapable of retiring. I’ll just work until either I go crazy (dementia or similar), or I simply die at my job. I’ll just work until I’m dead.

I’ve been so financially fucked by all the once-in-a-(insert large amount of time here) events that just coincidentally all happened during my life so far that this is what I’m expecting going forward. Record inflation, stagnant wages, everything as-a-service basically robbing you monthly for something you should have bought and long since paid off, but instead you’re paying for in perpetuity for no good reason…

Everything has turned into a monthly charge. It’s terrible, and you think “oh, it’s only $20 a month”. Yeah, that’s $240/yr. For something that probably doesn’t make you any money and probably doesn’t help you with your employment or any earnings you may bring in… It’s just a stupid tax. We’re stupid.

I have a bit of savings, but nowhere near 6 months worth. Just have had enough freak accidents and those “once-in-a-(insert large amount of time here)” events that having at least a month’s worth of savings has saved me from taking out more debt enough times that I try to keep something saved.

That said, while I’m sure the interest I’ve spent on my debt over the years has been enormous, the one silver lining to it all is that with inflation, my debt feels more manageable than it did 10 years ago. Not that I can really afford pay it off that much faster since every other part of life is more expensive, but in comparison to everything else, it feels much less overwhelming than it used to.

You will never make more interest on an investment than you will get charged interest for the same amount as a loan. Ever. It does not happen.

This is barely more accurate than a coin flip. Until 2021, it wasn’t that difficult to find loans with rates under 5%. Anything under 4% is basically free money and you’re normally better off investing in something low risk than to pay extra.

So for me to sit on money that could go towards paying down debts, I’m just needlessly paying more in interest than I would be otherwise.

If you don’t have any emergency funds, or not enough to cover a single large emergency, this is dumb. Cars break, roofs leak, etc. Even if you have an emergency where you can pay on credit, you’ll likely be looking at credit card interest rates. Or, you lose your job. Fun fact, most job loses occur when the economy is struggling. Another fun fact, most investments are doing really fucking poorly when the economy is struggling.

Keep some money on hand in case something happens.

It’s not always true that you can’t get a better interest rate for savings than a cost in interest. It is true that the money you could make in those scenarios is extremely small or at absurd levels of risk.

Well, you could invest in a stock that goes “to the moon” as they say… But that’s capital gains gambling, as far as I’m concerned.

Most interest/dividend payments will be far below what you’ll pay in interest on a loan, with few exceptions.

Investing in the stock market instead of paying a loan is stupidly risky. There’s a few loans that are possible where you could get a rate lower than some savings accounts, but you will only net 1-2% on your money in that scenario.

You will never make more interest on an investment than you will get charged interest for the same amount as a loan.

The historical S&P500 average is 11.88% annualised. Unless your interest rate is above this, you’re better off investing. In reality it’s more complex as there are tax considerations, liquidity, risk, opportunity cost etc to calculate. If your interest rate approaches this, paying down debt is indeed the best course of action.

The historical S&P500 average is 11.88% annualised. Unless your interest rate is above this, you’re better off investing.

It is.

My condolences.

I think there is a whole lot of variability in this equation. I do try to keep some “cushion” in the bank, but I can borrow if I have to. So if I have drained the savings I can still get by via borrowing for a while if necessary.

I’m fortunate that my employment is very steady. The chances of me losing my job are slim. If it were less steady I’d be better about keeping that cash stashed.

If the unlikely did happen and I lost my job I would pretty quickly have access to a large stash of cash. Which I’d rather save but would spend if it saves my ass from starving and foreclosure.

If you’re under 30, full-time job, no looming debts, no kids, then the 6 months can really be 3 months or around $10,000. If you have a partner, you are even more secure. Remember this is a figure derived from very conservative financial commentators who assume you have a linear college and job progression (which is rarely the case). Even a 1 month savings buffer will save you for 90% of the unexpected expenses.

If you’re in your late 50s, finding a new job will be tough, especially if you are laid off during a recession. In that case a generous buffer beyond 6 months would be good.

Either way, having savings is a good thing. Yes you will miss out on those “epic Bitcoin gains”, but once you have made an emergency savings buffer, then you can really knuckle down on contributions to retirement.

It’s generally 3 - 6 months of living expenses depending on your situation (generally on the low side unless layoffs are likely) which is very different than salary of an equivalent time frame

In my life it was either I could not save anything or I could save a lot, the expenses are basically the same but the income changed. Once the income was higher than the expenses the saving happened automatically and are steadily growing over time.

I’m 38 and I just achieved that goal.

Don’t stress about this shit (too much).

Go to concerts, take trips, eat your avocado toast. Indulge.

You’re only young once, and everyone is poor in their 20’s. Unless you’re lucky or it’s given to you.

It sounds trite, but success will come. However you measure it.

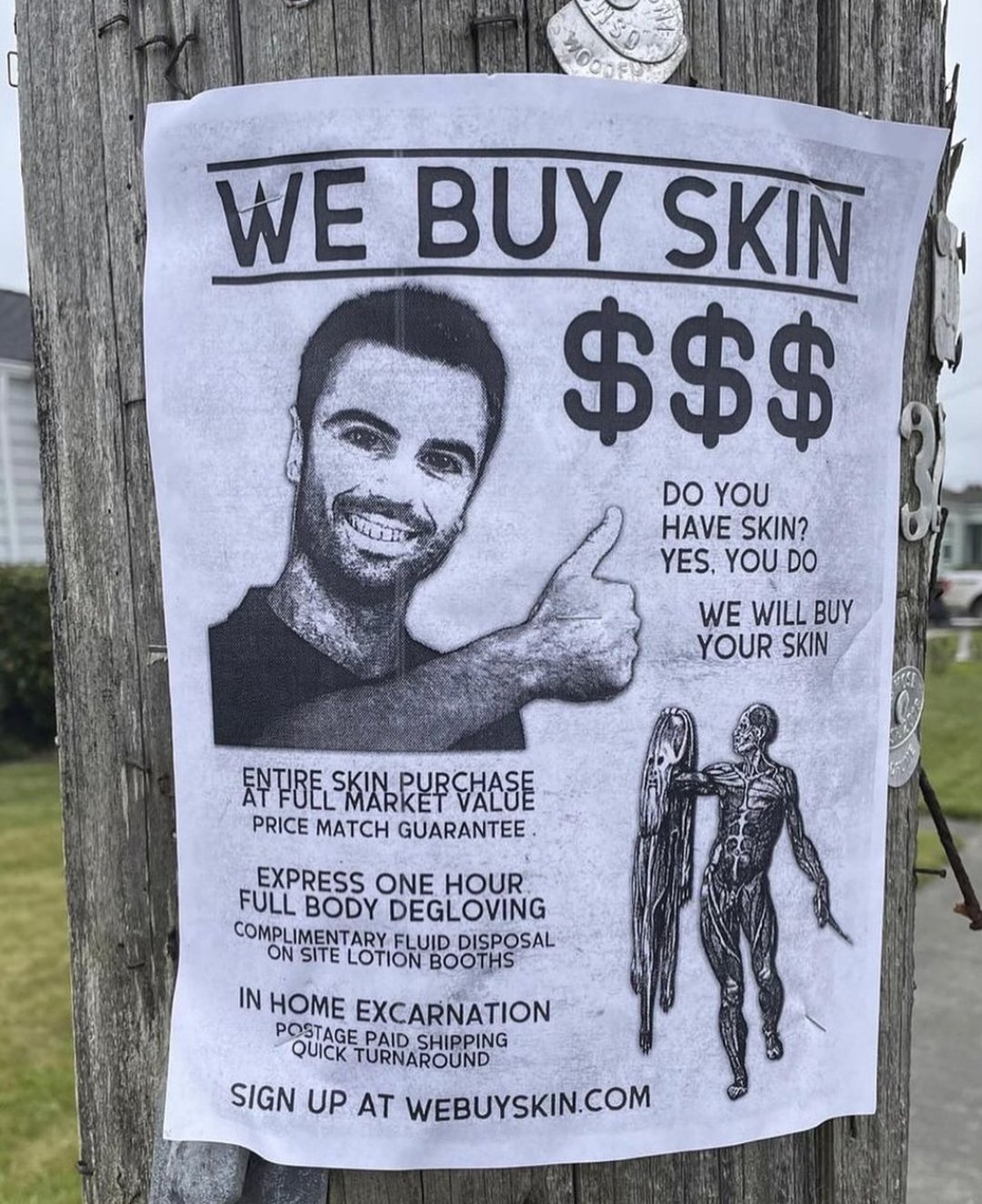

My “emergency fund” is basically whichever of my organs I can sell.

You might need this

6 month of work just sitting thete getting eaten away by inflation doesn’t spund smart. Either invest that shit or boof that shit while getting your dick sucked.

USD Inflation is ~3% per year currently, which is easy to beat with a high yield savings account. Anything more than 6 months should definitely go into an index fund though.

You can have your emergency funds in a high savings account as long as you can withdraw it without a pnealty

It is very smart. If you lose your job or have a major expense, not having to put it on credit provides you with a lot of stability, and you don’t have to pay interest.

-someone still paying off 4 months of unemployment a year ago

I have my emergency fund in a savings account with 3% interest rate. So my bank is giving me money each month for doing nothing really and I can withdraw my money whenever I want.

Where in the fuck are you getting 3% interest??

I am not endorsing this because I don’t have it myself and know nothing about it beyond this, but the savings account Apple introduced a year or two ago has 4.5% interest.

I’m sure anyone reading this in the UK is already aware of MSE but just in case: https://www.moneysavingexpert.com/savings/savings-accounts-best-interest/#easyaccess

A quick glance suggests most of those really high ones are time-limited bonus offers, but other places are doing quite high interest in general e.g. Marcus is paying 4.75%.

In germany. I don’t know how long these offers will be available but some banks already reduced the interest to 1,75% or something. I just switched bank for my emergency fund. I’m trying to be above the inflation rate which is currently something around 2,5%

Bank Norwegian is currently at 3.25%. Of course at times of 4% inflation it’s not enough

6mo CDs: up to 5.3%, no minimum

Around here, it’s usually not at a local physical bank. My online high yield savings is currently at 4.5% though; that’s where my emergency funds are.

You are barely keeping up with inflation, don’t think that’s an investment. That said, you are doing the right thing, keep that money available if needed.

Everything on top of 6 months expenses, you should invest in something less liquid that on the long term yields decent returns.

It’s not smart to use your emergency fund as an investment. The point is that you keep your emergency fund in an savings account that has at least an interest rate like the inflation rate and you should be able to use that money any time.

I never said that I’m doing an investment with that. No idea why you mention this.

This part made me think you were saying that was an investment, sorry I misunderstood

So my bank is giving me money each month for doing nothing really

I don’t have 6 hours of my salary in savings most days.

Yeah, im glad if I manage to play off my debt by 30 lmao

Consider the value of your purchases, that doesn’t mean buying the cheapest thing. It means buy the things that give you the most benefit. Price compare, don’t just blindly go to the store and buy something.

Don’t drive to the store to buy one thing. Go to the store if you’re already going past it or need to do a full run.

If you think you want to buy something you don’t necessarily need, don’t buy it immediately, put it in your online shopping cart and leave it there for a few days, then decide if you still want it.

Sell stuff that you don’t want or use anymore.

Never go out to eat/ order food if you can help it.

Stop drinking soda/energy drinks.

Stop smoking, doing drugs, and drinking alcohol.

Never go inside the gas station to pay, always pay at the pump. You’ll avoid impulse purchases and don’t buy lottery tickets.

Stop caring what other people think, you don’t need to buy a bunch of fancy clothes, shoes, the latest iPhone, etc. The only time you need to dress nice is a job interview and special occasions.

Show up to work on time, don’t complain out loud, and have a willingness to learn something new. You don’t have to be the best to get more money. Don’t stay at the same job if you’re not getting promoted or regular pay raises.

Buy a bicycle.

Floss your teeth, dental work is expensive.

Move to a higher cost of living area to get jobs that pay more. Rent is higher, but everything else costs pretty much the same so you’re better off and have more job opportunities.

Put as much money into your retirement account while you’re young, time in the market is better than timing the market.

Take care of your things, especially if you have a car. Maintenance costs less than a new engine.

Learn to fix things yourself

Go to thrift stores

Take advantage of free services, go to the library, they have access to a lot of online subscriptions.

Stay away from predatory loans from places like rentacenter, buy here pay here car lots and payday loans. Just don’t.

Don’t take out a car loan if you can’t afford it.

Get a savings/checking account with the highest interest you can find. It doesn’t have to be a local credit union/bank.

Do your own taxes for free, don’t pay someone to do them if you only have a regular job.

Get a roommate and split rent.

Take the bus/train.

Coupons/ deals/ rewards points.

Never talk to the cops.

Man, you’ve just sucked all of the fun out of life.

Touch grass 😘

I found a much easier method that was told to me is, (dont make a purchase unless you can afford to buy it twice)

I cant afford to fill up two tanks of gas, but i still gotta go to work. The economy is absolutely fucked no matter what economists say about avoiding a recession.

I’ve developed a bit of a variation on this: Don’t buy it unless you’re willing to put that number again into savings/investment. A little more strict, but also forces a careful analysis of short term-wants vs. long-term goals. Caveat: obviously some major expenses don’t qualify, but are necessary regardless.

I tried that but my landlord said if I didn’t pay the rent they’d kick me to the street.

Lmao i mean it’s just a general guideline not a hard rule

So if I want to accomplish this in a year I should be putting away half of every paycheck? Between rent, bills and groceries, who the fuck can afford that?

I make plenty of money and it took 15 years for me to get my emergency fund up to scratch.

Edit: of course, you can probably do it faster if you don’t have any emergencies while funding the account lol.

It’s supposed to be living expenses, not salary.

You can’t accomplish it in a year.

You don’t have to. Start early, save aggressively, get it done before you worry about upgrading your lifestyle.

Yeah this is a 5+ year goal right?

I world say it’s getting to 3-months first, then paying down debt with high-interest rates, then trying for 6-months of expenses. Could easily take a decade, but the idea is that once you have that 6-months saved, it’s less likely that you’ll re-enter into high-interest debt in the first place.

Saving 3 months in an emergency fund while accruing high interest debt seems crazy to me.

Most people, especially those not very knowledgeable about personal finance, really should follow the Dave Ramsey baby steps.

It’s a however long it takes goal. I’m hoping to have it done in 2, although 3 and change is more realistic.

Unfortunately, if you can’t afford to live with financial security, you can’t afford to live. I haven’t had an entertainment budget in over a year, and food has basically been what’s on sale at the grocery store and maybe a gyro every month.

I wish you the best of luck. It isn’t easy. Getting out of debt and having a fully funded emergency fund is a great feeling.

How long is a piece of string?

Depends on how much you earn, what are your expenses, and how much you have saved already.

Most people can’t afford it in a year.

People who inherited a sizeable amount of money or are in the top 10% of earners are able to do so.

Most people don’t accomplish 6 months emergency fund in 1 year, no. It’s a marathon, not a sprint.

Also, maxing out the $23.5K of the 401K retirement account.

Easy, have a side hustle selling drugs and pay everything cash.

“Just start a small business.”

That’s what I keep hearing from Republicans.

I actually owned a small business, which is why I understand what bullshit advice that is.

Just stop eating and photosynthesize like the rest of us responsible adults

Psh look at this sun breather. I just de-evolved myself by my bootstraps and float near a hydrothermal vent like a real adult

People with less expenses, people with a higher salary, people who live in a less expensive area, etc, etc.

6 months of expenses, not income.

Most people can. I make $40k per year in a major city, and I’m getting there.

Considering rent or mortgages alone takes a vast percentage of many people’s paychecks before you factor in things like student loan and medical debts, most people cannot.

And I have no idea how you can even live on $40k a year in a major city unless you’re eating beans and rice with every meal and living in a studio apartment with 4 other people.

Median income here is in the mid $60’s. I’m definitely poor, but I do save some money.

I live alone, and cook basically all my meals. Eating out and processed foods from a grocery store are both too pricey for more than once or twice a month. Mostly buy meat and fresh produce because carbs tend to give me stomach issues in large amounts.

Unfortunately, I am disabled. So while I have insurance, I cannot afford to see a specialist as regularly as I should. To be fair, this is out of network and like $700/month on top of my existing premiums and HSA contributions.

If nothing too crazy happens in the next year, I’ll be able to change jobs and get my medical care back in network, meaning I don’t need to ration doctor’s visits for my disability. If nothing happens in 2 or 3, I’ll have my emergency savings in a very good place. If nothing happens in 5, I might pay cash for my next car.

After that, fuck it. I’ll be financially stable, I’ll have another decade before I have a planned major expense like a car, and home ownership is a pipe dream here anyways. Last I looked, they start around $400k, which would mean coming up with about $180,000 for my down payment lol

Edit: Since you brought it up specifically, my rent and utilities is about $1200. I live in a very old building in a shitty neighborhood. The jail is right across the street, so there’s enough of a police presence to keep it safe. It is clean, but my landlord is fucking terrible and I have to sue or threaten to sue to get anything fixed.

Sorry that you have to go through all of that. I’m dealing with a mystery illness right now which involves food, so I understand.

Joke’s on you, i spend all my income

You should have an emergency fund. You never know when something bad will happen. For all you know your house could get bulldozed or you car could get damaged by something the insurance doesn’t cover

What happens if I don’t own a car or house :(

Well you still should have some sort of emergency fund

That’s my problem: I start saving and then suddenly I have a huge expense and I need to empty out my savings. Happens at least every six months.

It sounds like you built and then benefitted from an emergency fund. Nice!

Well I guess you could cut costs. I don’t know I’m not a financial advisor

I cook at home mostly, I don’t go on vacations, my cars are both at least 8 years old, and I live in a low COL area.

I guess I could kill one of my children but I don’t think that would make economic sense.

This sounds obvious/rude, but have you tried making more money?

You’re right.

It WOULD make economic sense to sell those kids into slavery.

Why not profit from those rug rats?

You’re right. Have your smartest kid set up a Minecraft smp server that has microtransactions

Or become a Ticktok star. All you need to do is confidently say made up facts

That means it’s working. You’re doing exactly what you need to and it’s absolutely paying off!

I’d argue that’s proof of your emergency fund working! You were able to save enough money to cover an unexpected expense/emergency without having to go into credit card debt.

Kudos! You should feel proud of yourself!

I agree with the others, you sound like the type of person that the emergency fund is designed for.

I had 9 months saved in 2020. I’m taking out loans this month because it’s at zero. It’s been a hell of a ride. This economy is fucked though.

Hey man, you live in a democracy. Go vote to change it. Oh wait. You can’t because you don’t live in a democracy.

Yeah! Take THAT person in an unfortunate situation. I bet you feel stupid for not having enough money to move, poor-y

You are so smart. Why don’t poor people just move to a democracy? Its only requires a bunch of money and sacrifice. Poor people should just abandon all of their friends, families, and connections by spending all of that money that poor people are known to have. That way they can live in a democracy and vote not to be poor, or whatever.

I got 12k debt and 300 in the bank haha

I have a little more in my account today, but last week I had the fun of saying, “I have $36 in my bank account but I’m still richer than Donald Trump.”

I still consider that a victory.

But you’re not. Trump is still living a lavish life full of excess, despite his debts.

Wealth is about lifestyle, not numbers.

That’s what people like Trump think, yes

Could… C-Could this be one of my people? It is! It is one of my people, hello! \o/