The Nanos Pocketbook Index fell to 50 last week, while gen Z respondents scored their lowest rating in at least 16 years. Read more.

The Nanos Pocketbook Index fell to 50 last week, while gen Z respondents scored their lowest rating in at least 16 years. Read more.

It’s US federal reserve among other research papers which may not translate to CA 1 to 1. However I wonder if a similar trend in sentiment. I see this quite often around housing prices. Yes, there was a surge and interest went up, but housing is still within budget for the middle class. The sentiment among young people seems to be I’ll never own a home and I need a million dollars.

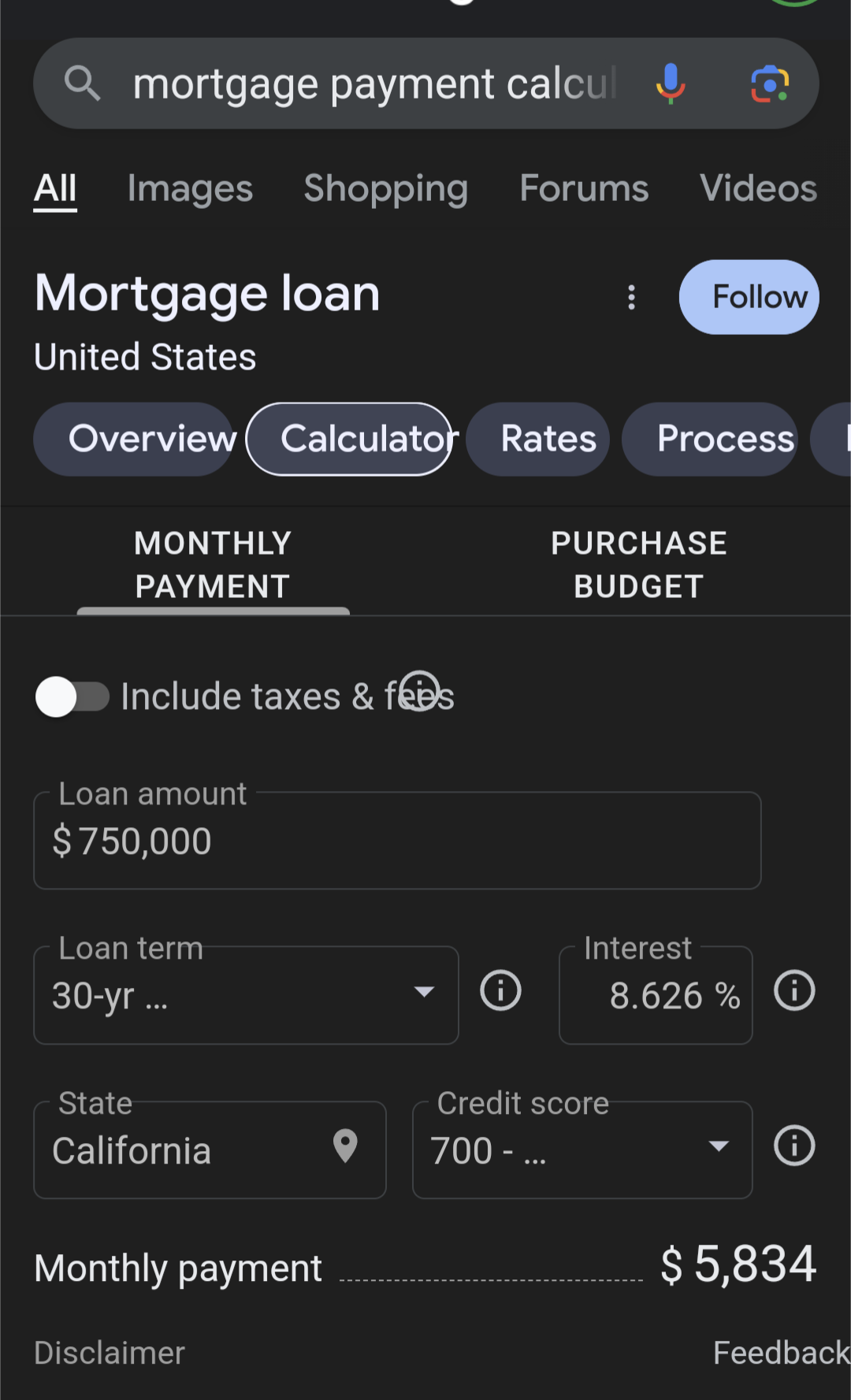

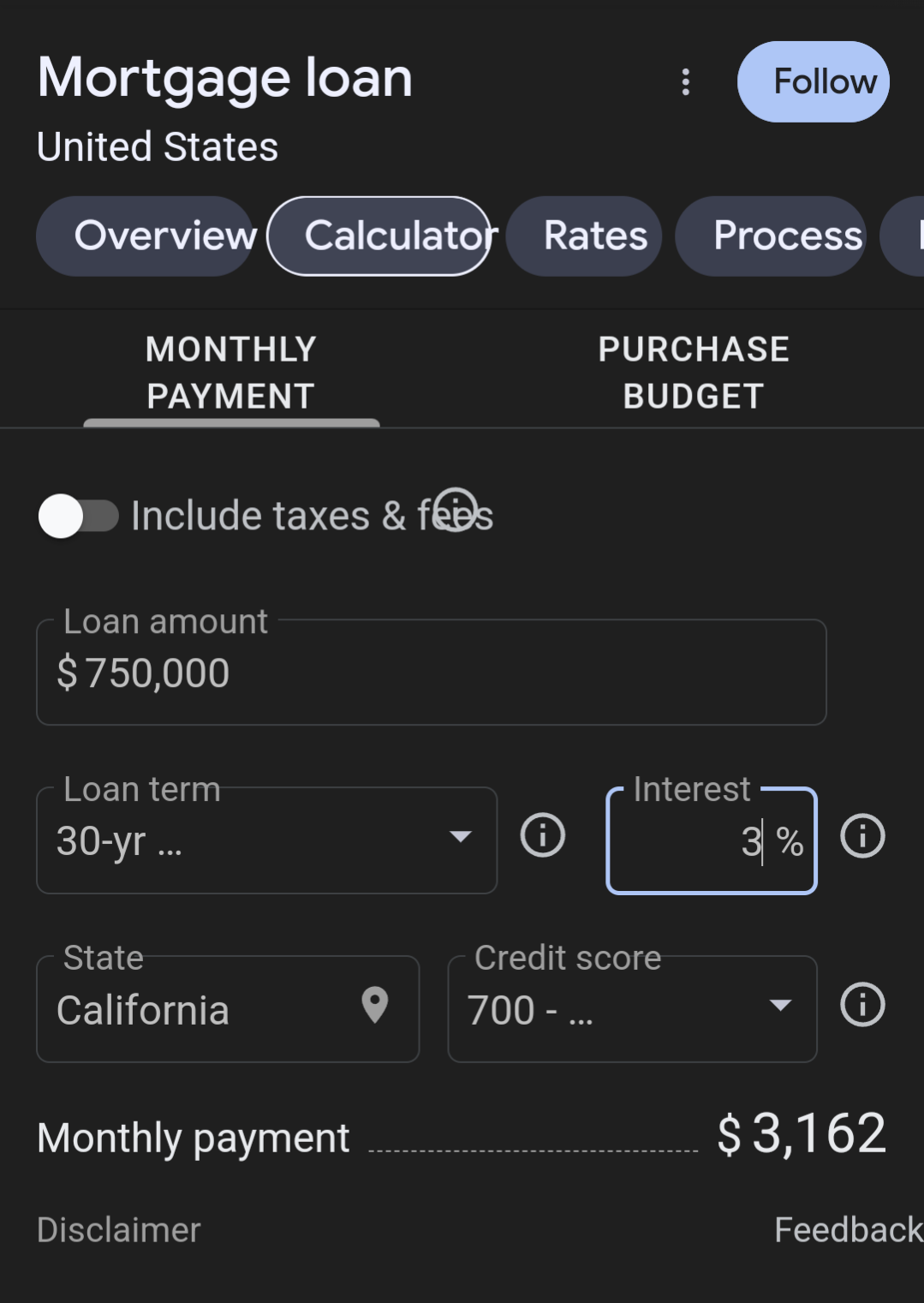

A mortgage payment has doubled in 3 years to buy the same house (assuming price was even the same which it often is significantly higher) What are you even talking about? This is not normal, and it’s fucked up that somebody who got a house 3 years ago got to pay half of what somebody who gets a house today. This is not capitalism. The market was already artificially high before covid, and then we let the richest people leverage themselves to the max on free money and buy up all the housing supply. The youngest people had the rug pulled on them the hardest. If you can’t see that, I don’t know what to tell you.

It hasn’t doubled, but the past 3 years have been a difficult change, I completely agree. The return to more normal rates, plus the temporary surge with COVID have priced some out of a home. But both these increases are back to normal and this hasn’t priced out most of the middle class. It’s more expensive, and we should try to make housing more affordable especially for those that don’t make enough to own, but hyperbole like yours is exactly what I’m referring to. It’s not double and gen z home ownership rates in the US at least are better than millennials.

Yes, it has.

Sure, if you use made up rates and exclude point buy downs.

Buying points involves paying more money up front to reduce interest rates. Given that someone struggling financially wouldn’t be able to do that I don’t think it’s fair to include them in conversations about the affordability of homes. It’s also not a great idea to buy points if you’re uncertain about whether you’re going to continue living there. It can take years for the savings on interest to recoup the up front cost of points, so you could easily lose money if something happens and you end up having to move or sell the home.

The “boots” theory of economic unfairness is pretty relevant here.

Edit: also the numbers the above commenter used are not far off, in the US average interest rates in 2021 went as low as 2.65%, and average interest rates in 2024 have been oscillating around 7%.

Home owners buy points all the time. I’m not talking about the rich either, this is done at middle class incomes. And as low isn’t a real metric. That 2.65 was going out to folks borrowing less with excellent rates. The average person taking out a 750k loan was absolutely not getting that rate. It would have been closer to 3.5%. You seem to be mixing average with the absolute lowest rate.

Yes the price went up. It wasn’t double.

I’m not mixing average with lowest rate, the average dipped that low in 2021, meaning lots of people were getting even lower rates than that. And yes, of course people with middle class incomes buy points. That doesn’t counter my point.